2022 Worldwide Review

As we entered 2022 – following two years focused on mitigating the impact of the Covid-19 pandemic – expectations of a return to normality and an accelerated post-pandemic recovery were high. The momentary respite however was deeply disrupted by the shock of the outbreak of war in Ukraine. The fragile recovery of supply chains was further impacted by record energy prices and producer price inflation at an unprecedented level in modern times. The subsequent inflationary pressures raised substantially the cost of living for our customers and the cost of doing business for our SPAR retailers worldwide.

Against this backdrop, we can be proud of the growth in turnover of SPAR internationally of 5.6% and international sales of €43.5 billion. When viewed over three years, and comparing the pre-Covid-19 period of 2019 to that of 2022, sales grew strongly by 3.75%, based on average annual exchange rates. This growth has been sustained over a longer period with a 2018-2022 CAGR (Compound Annual Growth Rate) of 5.2%.

The growth of SPAR has been built on the resilience of our supply chain with over 250 distribution centres linking a strong network of 13,996 stores, embedded in the communities they serve. Over 460,000 highly committed SPAR colleagues worldwide have shown great resilience in maintaining and growing our operations internationally despite the most turbulent and disruptive times our industry has faced in decades.

Regional Review

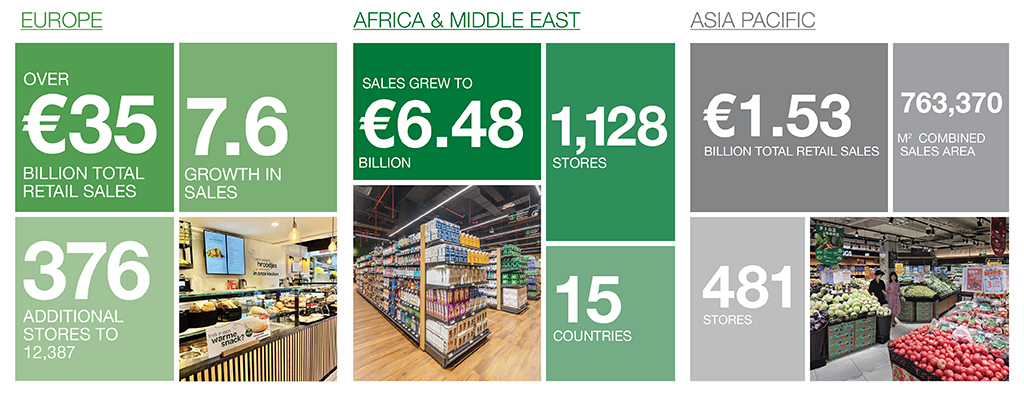

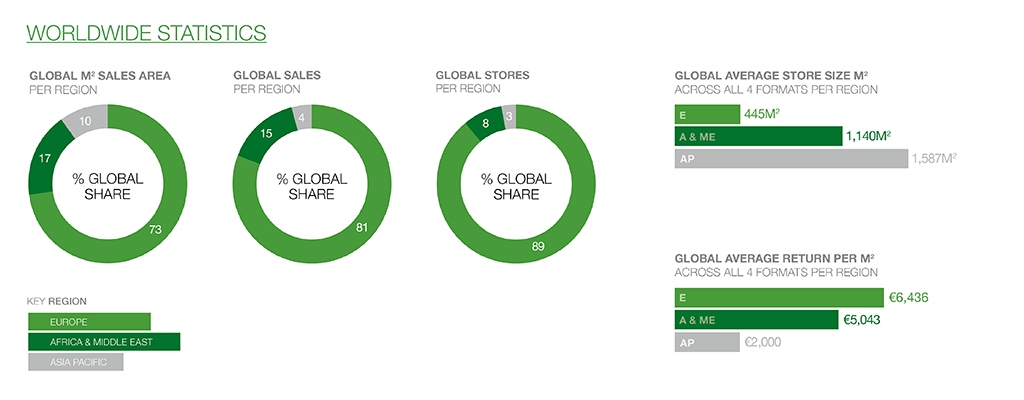

In Europe, growth in turnover of 7.6% led to a total retail turnover of €35.48 billion being generated from 12,687 stores operational in 28 countries, which have a combined sales area of 5,512,850m2. Ongoing investment in building the retail network in Europe saw 376 new stores being opened.

In Africa and the Middle East, the total retail sales in 2022 were reported at €6.48 billion, from 1,128 stores operating in 15 countries. SPAR has a presence in five countries in Asia Pacific and, despite the impact of severe and prolonged Covid-19 lockdowns in China and economic pressures in India, sales in 2022 reflected a return in those markets to stability. Retail turnover of €1.53 billion was reported in 2022 from 481 stores with a combined sales area of 463,370m2.

Multi-Format Strategy

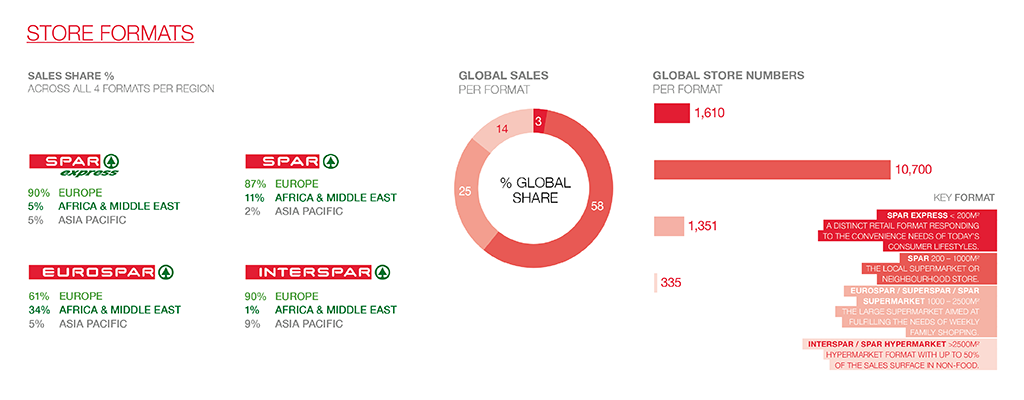

SPAR operates a multi-format strategy. The global portfolio comprises formats tailored to shopping missions and local customer needs: SPAR – the local neighbourhood supermarket; EUROSPAR – the supermarket for weekly family shopping; INTERSPAR – the hypermarket format; and SPAR Express – the convenience format for high traffic and transient locations.

The competitive advantages of the SPAR multi-format strategy and the critical role of independent retailing in communities across the globe were again clear factors of success throughout 2022. SPAR’s multi-format and multi-channel strategy provides agility to respond to changes in retail channel sales. After dramatic online growth, we forecast maturing of the online channel, providing the opportunity to enhance and improve the customer experience of our online and digital platforms.

Future Outlook

SPAR will continue to expand its footprint in 2023. Following on from the successful launch in Kazakhstan in 2022, additional markets in Central Asia will be introducing the SPAR Brand in the coming years. SPAR has entered South America for the first time with the launch of SPAR Supermarkets in Paraguay in mid-2023 in partnership with independent, family-owned retailers.

We have a strong and positive outlook for future expansion as independent retail chains in both developed and developing markets seek to join the SPAR organisation to benefit from the scale and synergies of the international SPAR Brand and its extensive network.

During continued volatility, the SPAR model of collaboration and uniting resources provides security and support to our new partners internationally. Inflationary pressures combined with challenging economic conditions will extend growing price sensitivity and polarisation of consumption patterns. This will see the increasing focus on value being interpreted into growth in the share of own brand sales and switching between brands as supply chains continue to be impacted.

New developments are planned for the roll-out of the SPAR International e-commerce platform to additional territories, as well as the scaling up of trials in quick e-commerce. Another element of this transition shall be the development of our retail media strategy, providing a more personalised approach to engaging with our customers and partnering with our supplier partners. These developments within our digital and data strategic pillars form a key part of our future strategy towards 2025.

SPAR continues to expand its presence and scale worldwide. With continued geographical expansion, acceleration in reaping the benefits of our recent development as well as increased international collaboration across retail and supply chains, we are well-placed to grow and prosper in the coming years.